分支机构的信息,包括大厅和开车的时间,可以在以下网站找到 Contact us.

Manage my money

-

我的支票账户是否提供透支保护选项?

是的。ACFCU可以通过两种不同的方式支付透支。

- Pay politely3 - 如果你符合条件,你会自动选择加入。你可以通过移动应用程序中的礼节性支付小工具选择退出。1 And online banking。

- Overdraft transfer - 如链接到另一个账户。

礼节性支付包括以下类型的交易。4

- 使用支票账户进行的支票、ACH和其他交易

- Automatic bill payment

- 使用你的借记卡设置的重复交易

- ATM transaction

- Daily debit card transactions

- Point of Sale (POS) transactions

我们还提供$30的宽限期。这意味着如果你的透支余额少于$30,借记卡交易就不收费。2

细则

1Data rates may apply。

2This only applies to debit card transactions。ACH交易在收取费用之前没有$30的宽限期。

3每次发生都要收取$30的费用。

4ATM transaction、Daily debit card transactions和Point of Sale (POS) transactions需要单独选择。

-

我如何为我的ACFCU账户在外部设置自动存款或提款?

如果您有电子付款,提款或存款从商家或其他金融机构进入您的账户(如工资存款或水电费付款),请通知该商家或机构您的账户号码和ACFCU的ABA路由号码:256078404。

-

我如何管理我的ACFCU账户的自动存款或提款?

您可以通过以下简单的步骤在您的ACFCU账户和外部账户之间免费转账(资金不足的情况下需要收取费用)。

1.You will need:

- Routing numbers of other financial institutions

- Your account type and number

- 访问您的ACFCU在线和/或手机银行业务。

2.按照ours指示一步步进行 ACH Initiate Setup Guide.

- 在有效工作日下午2点(美国东部时间)之前进行当日转账,否则将在下一个工作日出现。

- 每次转入或转出您的储蓄账户都将计入每月交易限额。

- 在 "预定转让 "功能下取消待定转让。

-

Do you provide telegraphic transfer?

是的,要向您的ACFCU账户汇款,只需向其他机构提供这些指示。

进线

- 电汇至阿灵顿沙巴体育APP下载联邦信贷联盟,ABA# 256078404

- Credit to。你的名字和你的13位数字的账号(在你的支票底部或通过Online banking找到)。

出线

- 可以在网上、当面、以及通过传真或电子邮件提出申请

-

我如何设置贷款支付的电子提示?

- Login to online banking

- Click your name in the top right corner

- 从下拉菜单中单击 "设置"。

- Click Notification。

- 在 "账户 "下,点击 "贷款支付到期日 "右侧的 "设置 "图标。

- Slide the button to ON

- 单击 "选择一个账户"。

- 选择贷款,然后选择到期日前后的天数,以收到警报。

- Click "Save"。

- 点击方框,表明接收警报的方式:电子邮件和/或手机。

- Click "Save Changes"。

要修改一个警报,请按照上面的说明进行。

要删除一个警报,请按照步骤1-6进行操作,并将按钮滑到关闭。

-

创建Online banking和手机银行的用户名有什么要求?

用户名必须由数字和字母组成,长度在8到15个字符之间. Old usernames cannot be reused.

Personal loan

-

What are the requirements to apply for a personal loan?

You must be a member or qualify for membership in ACFCU 在发放任何贷款之前,你必须先取得会员资格.

-

How much can I borrow with a personal loan?

我们提供1000美元到50000美元不等的Personal loan,视信用和收入条件而定.

-

What can a personal loan be used for?

Just about anything! Personal loan对于巩固债务或以比Credit card更低的利率为家庭开支提供资金是很好的.

- What is the process of applying for a personal loan?

-

When will I receive the funds from my personal loan?

一旦你的申请被批准,任何证明文件(如你的收入证明), if needed) have been provided, 您可以通过电子方式签署贷款文件,并在几小时内获得资金.

-

我需要什么类型的抵押品提供Personal loan?

Personal loans do not require collateral; however, if you do have collateral, like a paid-off vehicle, 你可以用你的抵押品以较低的利率获得更大的贷款.

-

Is there an advantage to paying off my loan faster?

Yes! 欢迎您在任何时候支付更多或额外的款项. 提前还款不会受到惩罚,而且在贷款期间你还能省下利息. 只要记住,你必须按时付款, even if you previously made a larger payment.

-

Do you offer payment protection?

Yes, 我们提供方便和负担得起的付款保障选择,在承保借款人残疾或死亡的情况下保护您和您的亲人.

Agreements, fees and penalties

-

我怎样才能审查阿灵顿沙巴体育APP下载联邦信用社的Privacy Policy?

You can visit our Privacy Policy Anytime online。

-

我怎样才能避免ATM机费用?

有三种方法可以避免ATM机的费用。

- Use free of charge 阿灵顿沙巴体育APP下载FCU自动提款机

- Open one Free bonus checking accounts 并符合每月返还高达$10的ATM费用的资格。

- Use an almost 30,000台Co-Op网络ATM机

-

你们的费用是什么,何时评估?

在适用的情况下,费用在整个月内评估,并将出现在你的定期月结单上。View our 个人。 沙巴体育APP下载 或 Start-up companyǞ Ǟ Ǟ Charging standard。

-

我怎样才能避免支付$5月度余额维持费或快递费?

你可以通过三种方式避免每月的维护费。

1. 保持$1,000的综合贷款和存款金额

2.Active use Free bonus checking accounts

3.我们对21岁以下或55岁以上的会员免收费用。

-

提前还清贷款是否有罚款?

不,我们不会因为你提前清偿贷款而惩罚你。如果我们为你关闭贷款支付了任何费用,或提供了现金返还奖励,如果你在开设贷款后36个月内关闭贷款,这些金额必须偿还。所欠的金额将包括在你的贷款清偿金额中*。

细则

*如果贷款在开业后36个月内还清,现金返还或过户费用可以加到还清金额中。

My account details and statements

-

我怎样才能更新和验证我的联系信息?

更新和验证您的信息是很容易和快速的。请按照这些简单的指示使用Online banking(桌面)或Mobile app (iOS或Android)。

Mobile app (iOS

1.Sign in to the mobile app

2.Go to more

3.Find someone else

4.Go to Settings

5.Go to contact

6.添加或更新你的电话号码、电子邮件地址和偏好

7.通过回答安全问题或输入电子邮件中的代码确认你的电话号码。Mobile app (Android

1.Sign in to the mobile app

2.进入汉堡包菜单(左上方的三行)。

3.Go to Settings

4.Go to contact

5.添加或更新你的电话号码、电子邮件地址和偏好

6.通过回答安全问题或输入电子邮件中的代码确认你的电话号码。Online banking

1.Login to online banking

2.Go to Settings (top right)。

3.Go to contact

4.添加或更新你的电话号码、电子邮件地址和偏好

5.通过回答安全问题或输入电子邮件中的代码确认你的电话号码。 -

我怎样才能更新我的电子邮件或街道地址?

- Log in to our Mobile application1 Or online banking

- 点击 设置,那么 Contact us

- Change your personal information

-

我什么时候能收到我的报表?

如果你有一个有效的支票账户或贷款,你会收到月度报表。否则,你将收到季度对账单。对账单周期从每月的第一天到最后一天。If you are Registered an electronic statement当你的电子账单可用时,你会收到一封电子邮件。

-

How do I get an e-bill?

你可以通过点击以下链接访问你的电子账单 Electronic document Gadgets in online banking。

-

我的电子账单库中会有多少个月的电子账单?

一旦您注册了电子账单,您的电子账单库将存储过去24个月的电子账单。

Mortgages and home equity

-

在申请Mortgage loan之前,我应该做什么?

申请新的Mortgage loan或为你目前的Mortgage loan再融资?Please refer to this handy Mortgage application Checklist 来了解你需要哪些表格来保持程序的进展。

-

我怎样才能更好地理解这些术语?

不知道你的摊销额和你的回收额?Don't worry!ours Glossary of mortgage terms 将分解你需要知道的一切,帮助你听起来像个专家。

-

你知道任何Mortgage loan申请技巧吗?

We've compiled ours 申请Mortgage loan时的十大提示 以帮助你成为一个强有力的申请人,使你能够为你的梦想之家融资。

-

我怎样才能更好地了解这个过程?

购买或再融资房屋可能会感到压倒性和混乱,但有了ours 了解Mortgage loan程序的指南It doesn't have to be that way。

-

在申请Home equity贷款或额度之前,我应该做什么?

准备完成你的Home equity贷款申请,在ours网站上打勾。 Home equity Application Checklist.

-

我如何申请一份排序协议?

申请从属关系很简单,只需按照以下步骤即可。 Description of assignment agreement.

-

我在哪里可以找到Home equity付款和报表问题的答案?

在ours网站上快速回答你所有最紧迫的房屋资产问题。 Frequently asked Questions Payment and statements 指南。

-

我如何使用我的信用额度?

了解如何使用你的Home equity信贷额度从未如此简单,ours Common problems in obtaining a line of credit 指南。

*这同时适用于消费贷款和股权贷款。

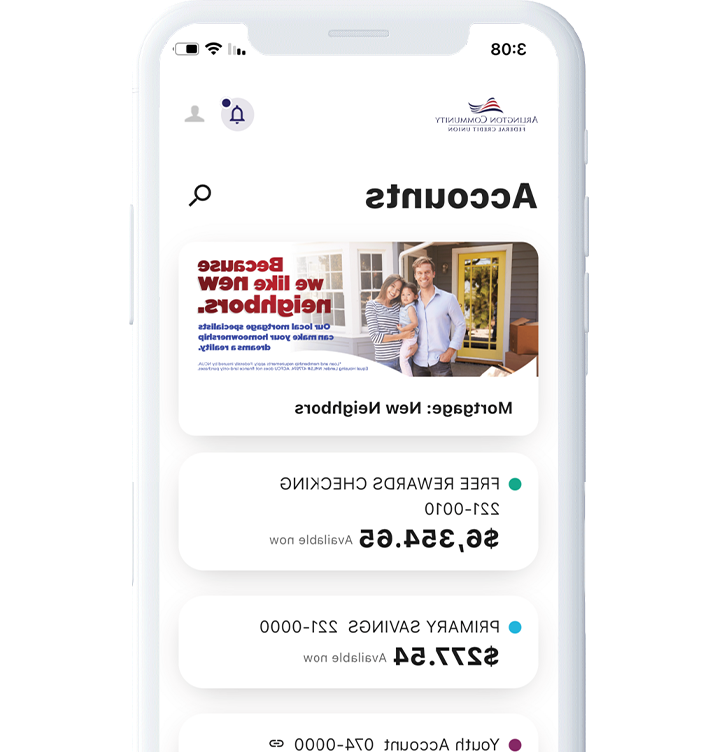

Free bonus checking accounts

-

我何时能收到我的借记卡?

邮寄。7-10 business days

Be present at the scene。Instant issue option

-

我什么时候开始在我的账户上赚取奖励?

有资格立即开始累积交易(在支票账户开立或从基本支票转换后立即开始),奖励在月底应用到账户中。如果支票账户在月底前被关闭,那么奖励就不会被应用。会员可以使用OLB和移动应用程序中的奖励签到小工具来跟踪他们的进展。

-

如果我透支我的账户怎么办?

Overdraft does not affect rewards。

Open account。

- Pay politely

- Overdraft transfer

-

是否有任何费用或最低余额要求?

Free bonus check no。如果不符合要求,基本支票可能会被收取快递费。

-

I'm going to open a checking account。Where should I start?

New member。可以亲自到分行或在网上开通。

Existing members。可以亲自到分行开立,也可以在网上开立,或通过电话开立 703.526.0080 x4.

Business credit card

-

我可以从我的主要Credit card账户中转出吗?

不,那张主要的Credit card是存放资金的地方。要进行转账,你必须进入转账屏幕,选择Credit card作为 "来自 "账户,然后选择一个股票作为 "到 "账户。

-

What is a Business Cardholder?

商务卡持卡人有一张由业务管理员分配给他们的Credit card. 他们不能要求增加额度,也不能报失或被盗等. Any maintenance requests must be submitted by the Guarantor. 如果您是担保人,请致电800-637-7728联系持卡人服务.

-

How do I raise a dispute?

只有担保人可以提出争议。他们需要通过800-637-7728联系持卡人服务。

-

How do I file a fraud claim?

只有担保人可以提出欺诈索赔。他们需要通过800-637-7728联系持卡人服务。

-

How do I set my password?

现在就拨打PIN电话800.631.3197,输入EIN和企业电话号码。

-

当我使用个人账户凭证登录时,是否会看到我的Business credit card?

不,个人账户将与企业账户保持分离。

-

我的Business credit card的到期日是什么时候?

在25日钍 Next month。

-

我如何用我的Business credit card进行支付?

- 从商业支票账户在线转账到控制卡。

- 将支票寄给持卡人服务部--在对账单上找到的地址。

- Pay at a branch。

-

How do I register for e-billing?

1. 从你的电脑登录你的Online banking账户,然后进入 eDocs gadget

2. Click to enter 概述

3. Click to enter 认购设置 caret: V

4. Click to enter 齿轮

5.选择 订阅!

-

沙巴体育APP下载我的Credit card在有余额的情况下说我的余额为零?

在您的在线视图中,您只能看到您的交易。业务管理员可以查看所有持卡人的所有交易记录和余额。

-

我如何对一项收费提出异议?

Contact your sponsor。

-

How do I order a replacement card?

Contact your sponsor。

-

How do I reset my online access?

请联系您的业务管理员以解锁您的在线访问。

Savvy Money

-

Is Savvy Money free?

Yes! 精明的钱是一个免费的服务,可在Online banking和手机.

-

注册或使用Savvy Money会影响我的信用并可能降低我的分数吗?

No! 在credit Score上查询信用评分是一种“软查询”,不影响信用评分.

-

What scoring model does Savvy Money use?

Vantage 3.0

请注意,Vantage分数和FICO分数可能不同,并可能导致不同的信用等级/利率.

-

What bureau does Savvy Money pull credit profiles from?

Transunion

-

透过这项信用监察服务,我的私隐如何得到保障?

报名时,您必须先登录ours安全Online banking或移动平台. Your credit information is never shared with third parties.

-

Savvy Money的信用评分与其他信用监控应用程序或贷款应用程序有什么不同吗?

Yes. Three major credit reporting bureaus—Equifax, Experian, 和transunion——以及两种评分模型——fico或vantagescore——决定信用评分. 金融机构/贷方使用不同的机构,以及评分模型. 在计算分数时,信用报告中的200多个因素可能会被考虑在内, and each model may weigh credit factors differently. 因此,没有评分模型是完全相同的,但方向应该相似.

-

沙巴体育APP下载我的信用评分与贷款申请上的评分不同?

精明的钱是一个信用监控工具,我们提供给你免费Learn more关于你的财务决策如何影响你的信用评分. 您可以预期您的分数会有所不同,因为我们会考虑您的贷款申请中的其他信用因素,这些因素在此工具中不可用,可能会导致不同的分数.

像Savvy Money这样的信用监控工具使用了Vantage Score 3这样的评分模型.0 to display your credit details. 在使用FICO评分模型审查您的贷款申请时,我们还会考虑其他信用因素. 使用不同的评分模型是你看到你的分数不同的原因.

没有评分模型是相同的,但方向是相同的. 如果你的分数上升基于你的信用活动在精明的钱, 你可能会看到我们在贷款申请中的分数也会增加.

-

What if I see an error on my credit report?

If you find incorrect information in your credit report, 联系开立账户的公司或出具报告的信用报告公司.

在参考资料下的FAQ小节中还有关于如何解决这类问题的更多信息.

-

Can I download my credit report in Savvy Money?

Yes! 在信用报告页面,点击右上角的“下载报告”.

-

When does my status change to inactive in Savvy Money?

如果您超过120天没有Login to online banking或手机银行, your Money Savvy will go inactive, and you will be unenrolled. 要重新注册,请按照正常的注册程序重新获得对您的个人资料信息的访问权限.

-

Can I unenroll from Savvy Money?

Yes. On the Resources tab, select “Profile Settings”, 滚动到最底部,选择“停用信用评分帐户”.“一旦注销,你可以随时通过Online banking或手机银行重新注册.

-

Can I receive alerts from Savvy Money?

您可以从信用评分接收信用警报、月度通知和一般消息.

-

Can I turn off email notifications from Credit Score?

Yes. 您可以通过导航到资源选项卡来管理电子邮件通知, selecting “Profile Settings”, and changing their preferences under Email Notifications. 您还可以在收到的电子邮件底部更改订阅设置.

-

Who responds to the questions Contact Us option?

精明的钱将回答有关信用评分和他们的网站的一般问题. 任何具体的信用社问题将被重新定向到ours数字银行团队.

Why Arlington

作为一个提供全方位服务的信用社,我们是一个像您一样的会员的合作组织,我们知道,通过团结一致,我们都可以在ours财务旅程中受益。

Financial empowerment

我们在这里帮助ours会员和邻居实现他们的财务目标,过上最好的生活。

Reward experience

我们认为,没有什么比服务于ours会员更有意义的了,并且相信一次好的转折值得另一次。

Integrity first

我们不仅满足您的金融需求,还承诺做您的好邻居,诚信服务。